www.cgdev.org

1776 Massachusetts Ave., NW

Third Floor

Washington, D.C. 20036

Tel: (202) 416-0700

Fax: (202) 416-0750

China ExIm Bank and Africa:

New Lending, New Challenges

T

odd Moss and Sarah Rose

odd Moss and Sarah Rose

odd Moss and Sarah Rose

odd Moss and Sarah Rose

odd Moss and Sarah Rose*

November 2006

*

Todd Moss (tmoss@cgdev.org) is a senior fellow and Sarah Rose (srose@cgdev.org) is a research assistant at the Center for Global

Development.

Policy Summar

Policy Summar

Policy Summar

Policy Summar

Policy Summary:

y:

y:

y:

y:

•

Wise up.

Wise up.

Wise up.

Wise up.

Wise up. Recognize that

China is already a major

force in Africa and that China

ExIm is playing a key role.

•

Don’

Don’

Don’

Don’

Don’t Panic.

t Panic.

t Panic.

t Panic.

t Panic. China’s

activities reflect its stated

foreign policy strategy; it is

using tools similar to those of

other powers.

•

Use what you have.

Use what you have.

Use what you have.

Use what you have.

Use what you have.

Where China is acting

outside norms, there are

existing institutions to be

tapped, such as the WTO to

enforce rules on subsidies and

the IMF to prevent a new

African debt problem.

•

Engage for the long-ter

Engage for the long-ter

Engage for the long-ter

Engage for the long-ter

Engage for the long-term.

m.

m.

m.

m.

Work to bring China into the

OECD tent on disclosure and

other rules.

Source: 2005 Annual Report of the Export-Import Bank of China

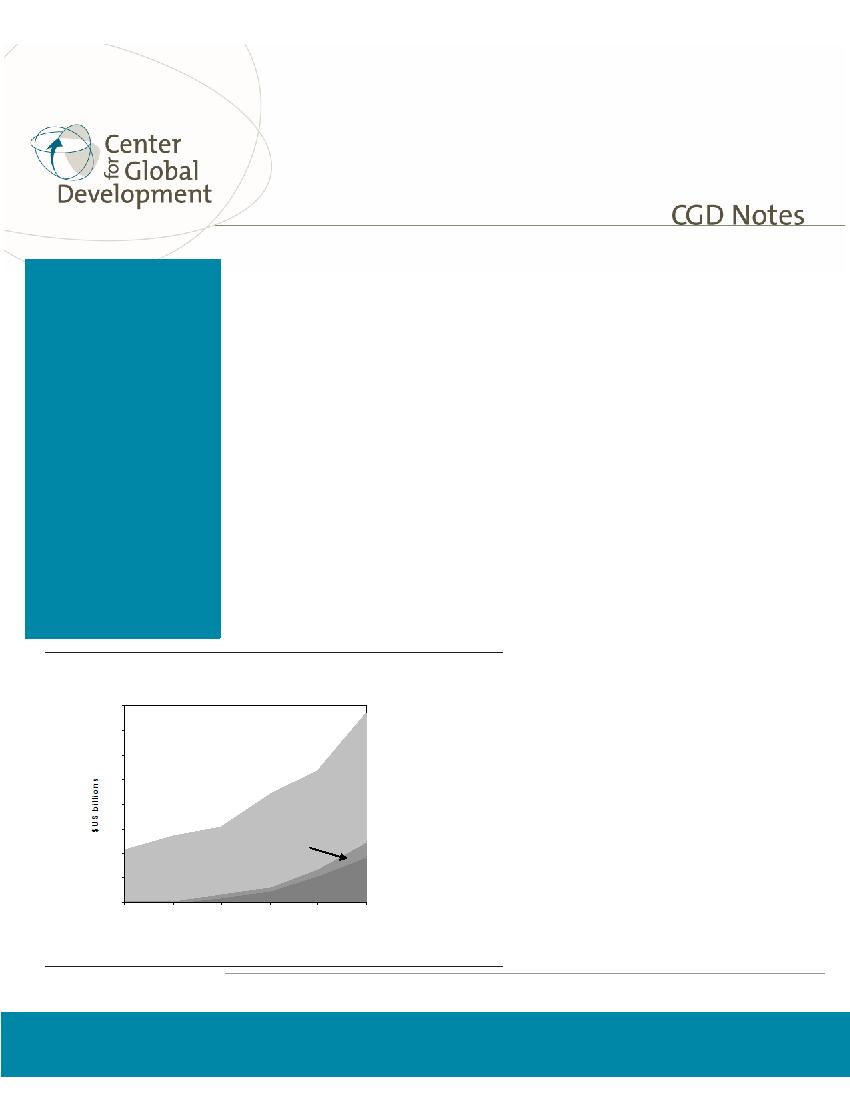

Figure 1: China ExIm, Main operations

International

guarantees

Export

buyers credit

Export sellers

credit

0

2

4

6

8

10

12

14

16

2000 2001 2002 2003 2004 2005

T

TT

TT

he

rise of China’s economic and political might

has been felt especially strongly in Africa. China

has long been actively engaged on the continent,

beginning with colonial-era support for nationalists

and mass construction of railways and stadiums in

the early independence period. More recently,

China has made a renewed push into Africa as part

of its foreign policy strategy to secure access to

natural resources and reassert itself on the global

stage. The Export-Import Bank of China is a

growing—if still mostly unknown—instrument of that

strategy, not only to boost trade and investment, but

also to enhance Chinese influence abroad. This

Note presents some of the basic facts about China

ExIm and identifies several potential implications for

Africa and the West.

What is China ExIm.

What is China ExIm.

What is China ExIm.

What is China ExIm.

What is China ExIm.

The Export-Import Bank of China, established in

1994, is wholly owned by the government and its

management is appointed by, and reports to, the

State Council. China ExIm, along with its two sister

organizations, is tasked to promote exports and

investment.

1

Its main activities are export credit,

international guarantees, loans for overseas

construction and investment, and official lines of

credit. The Bank’s portfolio has grown

dramatically, with annual disbursements more

than tripling in five years to $15 billion (Figure 1).

Although exact comparisons are difficult because

of reporting differences, it appears that China

ExIm is now one of the largest export credit

agencies, with primary commercial operations in

2005 greater than those of the lead agencies in

the United States, Japan or the United Kingdom

(Figure 2). However China is not a member of

the OECD and operates outside the export credit

rules agreed by other countries.

China ExIm in Africa

China ExIm in Africa

China ExIm in Africa

China ExIm in Africa

China ExIm in Africa

The Bank’s activities are not reported regionally,

but there is clear evidence of significant and

expanding operations in Africa. In 2005 the

Bank extended its export buyers credit market to

Africa. In January 2006 the government

released its official “African Policy” which

specifically “encourages and supports Chinese

enterprises’ investment and business in Africa,

and will continue to provide preferential loans

and buyers credits to this end.”

2

In addition,

several ExIm projects have been announced in

the media. Although such reports are sometimes

not reliable, reported projects in the past two

years alone include:

•

A possible $1.2 billion in new loans to Ghana,

including $600 million for construction of the Bui

dam;

•

$2.3 billion in total financing for Mozambique

for the Mepanda Nkua dam and hydroelectric

plant, plus another possible $300 million for the

Moamba-Major dam;

•A $1.6 billion loan for a Chinese oil project in

Nigeria;

•$200 million in preferential buyers credit for

Nigeria’s first communications satellite;

•

A $2 billion line of credit to Angola, with the

possibility of another $9-10 billion;

•Reports of loans and export credits for other

projects in Congo-Brazzaville, Sudan and

Zimbabwe.